The concept of horizontal and vertical integration in operational portfolios has significantly impacted businesses across various industries. To understand how these integrations function in practice, a detailed case study can offer valuable insights. This particular study focuses on an insurance company from the mid-to-late 1990s, a period characterized by substantial technological advancements and organizational restructuring. During this time, the practice of Business Process Reengineering (BPR) emerged as a response to the transformative effects of information technology.

Business Process Reengineering

Business Process Reengineering refers to the radical redesign of business processes to achieve significant improvements in productivity, efficiency, and quality. The rise of Personal Computers (PCs) and Client-Server Architectures during the 1990s introduced a wave of technological change that profoundly affected service companies. However, contrary to initial expectations, manufacturing companies did not experience the same level of disruption. This discrepancy was primarily because manufacturing firms had already undergone significant transformations through technologies like Computer-Integrated Manufacturing (CIM) and Material Requirements Planning (MRP).

While the concept of BPR applied effectively to service companies, it was often misinterpreted when applied to manufacturing industries. In hindsight, it became evident that manufacturing organizations had already optimized their operations through previous technological advancements, reducing the necessity for further reengineering. As a result, claims of BPR failure in manufacturing companies often reflected a misunderstanding of its applicability.

The Insurance Company Case

The case study focuses on a large insurance company with a particularly extensive Information Technology (IT) infrastructure. By the mid-1990s, this company employed approximately 3,000 IT professionals and managed around 25,000 PCs. This scale of operation posed numerous challenges in maintaining IT support, providing end-user services, and ensuring operational stability. Despite initial concerns that the organization faced significant IT issues, further analysis revealed that the company was not burdened by a crisis but instead presented with numerous technological opportunities.

Rather than treating the perceived IT issues as mere technical problems, the company recognized the potential for strategic growth through enhanced operational integration. This led to the implementation of horizontal and vertical integration across its operational portfolio.

Challenges and Strategic Decisions

One of the primary challenges the company faced was maintaining consistent operational support for 25,000 users. Managing user requests, troubleshooting technical issues, and ensuring continuous system availability required a highly organized and responsive IT function. Additionally, the reliance on legacy systems and fragmented software solutions limited the company’s ability to respond to changing market demands.

To address these challenges, the company adopted a phased approach to integration. They began by streamlining their operational processes through standardized software applications. This not only simplified system maintenance but also provided real-time data visibility across departments. Moreover, the organization invested in training IT personnel to develop expertise in emerging technologies, ensuring the sustainability of the integration efforts.

Agile Software Development

Managing an organization’s software portfolio has always been challenging, especially for large enterprises like insurance companies, which often employ thousands of in-house developers. Over time, a major issue has emerged: a growing share of the IT budget is spent on maintaining existing systems, leaving fewer resources for new projects.

This problem stems from the nature of software. Initially, developing a new system is straightforward, with costs allocated to writing and deploying code. However, as time passes, maintaining the system becomes increasingly costly due to tasks like bug fixes, security updates, and performance improvements. As more budget is diverted to maintenance, less is available for new development. This cycle repeats, making it harder for organizations to innovate.

Another challenge is legacy systems—older software that is difficult to completely replace. Companies often operate with both outdated and modern systems, requiring updates and compatibility maintenance for both. This results in a trade-off between sustaining existing systems and investing in innovation.

Agile software development tackles the challenges of software maintenance and innovation by focusing on incremental and iterative approaches. Instead of building and deploying entire systems at once, Agile breaks projects into smaller, independent modules. This modular structure allows different parts of an application to evolve separately, reducing maintenance costs and preserving resources for innovation.

Agile emphasizes designing software as discrete components with well-defined APIs, so updates to individual modules don’t impact the whole system. This minimizes the risk of widespread failures and makes maintenance easier and faster. Smaller components are also simpler to debug, enabling quicker problem resolution and more predictable upkeep efforts. Furthermore, Agile practices like continuous integration and deployment (CD) ensure regular, tested updates, keeping software stable and functional with minimal disruption.

Challenges in IT Operations and End-User Interaction

Beyond maintenance, another critical aspect of software lifecycle management is operations—ensuring that software functions effectively in a live environment. A significant challenge in IT operations is the interaction between technical teams and end-users. Unlike developers who understand the complexity of software modifications, end-users often perceive changes as simple requests. They may demand alterations without grasping the level of effort required to implement them.

Example

For instance, a business user might submit ten feature requests, expecting them to be implemented quickly. However, a developer must assess each request for feasibility, resource allocation, and impact on existing functionality. Some changes may be trivial, while others could require extensive rewrites, significantly delaying their implementation.

The disconnect between business expectations and technical realities often leads to frustration and a lack of trust. Business stakeholders may suspect that IT teams are either inefficient or exaggerating difficulties, while developers may feel overwhelmed by unrealistic demands.

This friction underscores the necessity of effective IT governance and communication strategies. Successful IT leaders, such as Chief Information Officers (CIOs), must possess both technical expertise and managerial skills. Without technical knowledge, a CIO may struggle to mediate between developers and business stakeholders, making informed decisions about which projects to prioritize. On the other hand, failing to communicate IT constraints effectively can lead to misaligned expectations, reducing organizational efficiency.

Importance of IT in Business Transformation

Modern enterprises must recognize that IT is no longer just a support function—it is a core enabler of business transformation. Information technology is not merely about maintaining systems but also about driving strategic change, improving coordination, and enabling new business models. However, for this to happen effectively, business leaders must develop a foundational understanding of IT. They need to collaborate with IT managers, not from a position of skepticism but based on mutual trust and knowledge.

To address the issues and challenges associated with IT system changes, it is essential to first understand the concept of technological obsolescence. As information technology evolves, older systems and the associated skill sets often become outdated. This can lead to difficulties in maintaining competitiveness and operational efficiency. Companies that once relied on mainframe-based applications may find it challenging to adapt to new technologies, particularly those involving artificial intelligence (AI) and client-server architectures.

The primary concern in such scenarios is the inability of the existing workforce to adapt quickly. Employees who are accustomed to traditional systems may lack the necessary skills to manage and develop applications using modern frameworks. As a result, organizations may face resistance to change, knowledge gaps, and a lack of productivity during the transition period. One prevalent solution to mitigate this issue is outsourcing: by engaging external consultants or service providers, companies can leverage external expertise while reducing the complexity of in-house management.

A notable case study in this regard is the business process reengineering (BPR) project undertaken by Cigna, a large insurance company. Faced with outdated legacy systems, Cigna opted to collaborate with a consulting firm, bringing in an external consultant with a strong technical background. This consultant played a crucial role in communicating the opportunities presented by modernizing their IT infrastructure. Through BPR, the company aimed not only to replace obsolete systems but also to enhance its operational capabilities, leading to increased customization of services and improved customer satisfaction.

Service personalization was a key driver for Cigna’s BPR initiative.

Example

The consultant illustrated the importance of providing customized insurance policies, using the example of a niche product like insurance for “drag cars” — a specialized form of motorsport. In regions such as Montana, where customer demands might vary significantly, agencies required the capability to address unique insurance needs. Without sufficient technical infrastructure, the company would risk losing customers to competitors who could provide tailored services more efficiently.

Furthermore, risk assessment posed another significant challenge. Insurance companies rely heavily on historical data to calculate the probability of claims and set premiums accordingly. Prior to modernization, Cigna’s data management was fragmented, with essential information stored on paper. This manual system required substantial effort to extract and analyze relevant data, making risk assessments both time-consuming and error-prone.

Another significant advantage of implementing modern IT systems was the reduction in employee specialization. Traditional approaches often required extensive specialization among insurance agents, limiting their ability to handle diverse customer requests. By adopting a client-server architecture and utilizing centralized databases, agents gained access to broader sets of information. This enabled them to offer a wider range of services, enhancing customer satisfaction while streamlining operations. However, transitioning to modern systems came with its own set of managerial challenges. In Europe, and particularly in Italy, labor laws often make it difficult to lay off employees compared to the United States. Companies navigating digital transformation had to carefully balance workforce restructuring while ensuring business continuity. In many cases, this involved reskilling or upskilling existing employees to adapt to the new technological landscape.

Managerial Issues

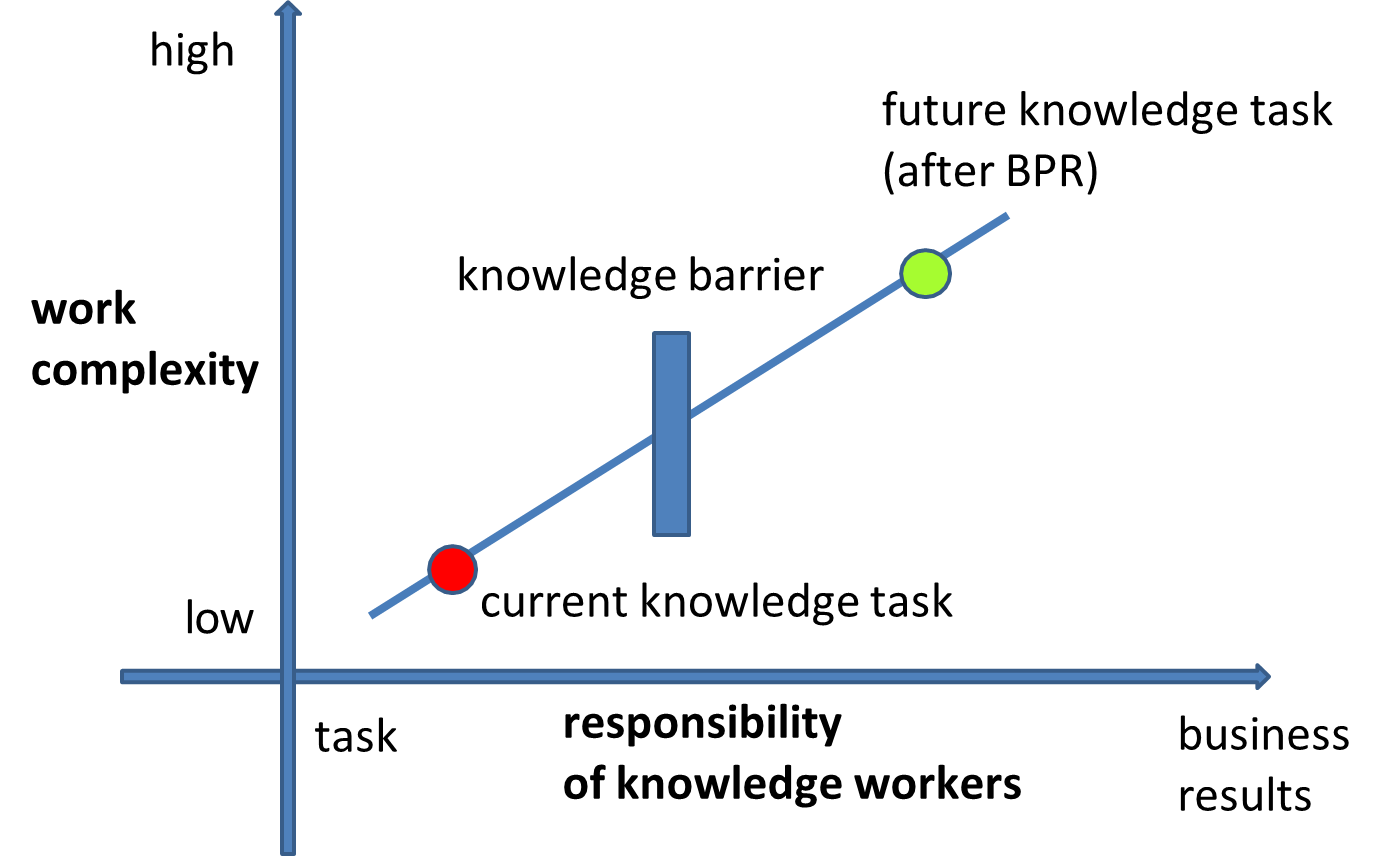

In insurance agencies, one significant challenge is the knowledge barrier that exists between employees and the information they need to execute their tasks effectively. Insurance agents are often tasked with assessing risks, recommending suitable policies, and managing customer interactions. However, due to the inherent complexity of insurance policies and the diverse needs of customers, agents may struggle to navigate the vast amount of information required for decision-making.

To address this challenge, agents are encouraged to transition from specialists to generalists. This transition requires acquiring knowledge across multiple areas, which may include understanding various insurance products, legal clauses, customer relationship management, and risk assessment.

Incentive Systems and Business Objectives

Agency theory provides a theoretical framework to understand how incentive systems can align the interests of agents with those of the company. According to this theory, employees tend to perform better when their rewards are directly linked to business outcomes. Therefore, insurance companies often implement incentive systems that reward agents based on their ability to meet sales targets, retain customers, and manage risks effectively.

In this scenario, the company’s objective is to enhance sales while ensuring customer satisfaction and maintaining profitability. By introducing well-structured incentives, insurance companies encourage agents to adopt proactive sales behaviors and offer policies that meet the specific needs of their clients. Furthermore, a comprehensive performance management system can monitor and evaluate agents’ performance, promoting accountability and continuous improvement.

Desktop Applications in Streamlining Processes

To further support agents in overcoming the knowledge barrier, insurance companies have developed desktop applications designed to simplify complex tasks. These applications are typically integrated with the company’s operational database, providing agents with real-time access to relevant customer data and policy information.

A desktop application tailored for insurance operations performs several critical functions:

-

Guided Underwriting Process: Through a series of structured inputs, the application guides agents through the underwriting process. Based on customer responses, the system dynamically suggests follow-up questions to gather all necessary information. This reduces the likelihood of errors and ensures a comprehensive risk assessment.

-

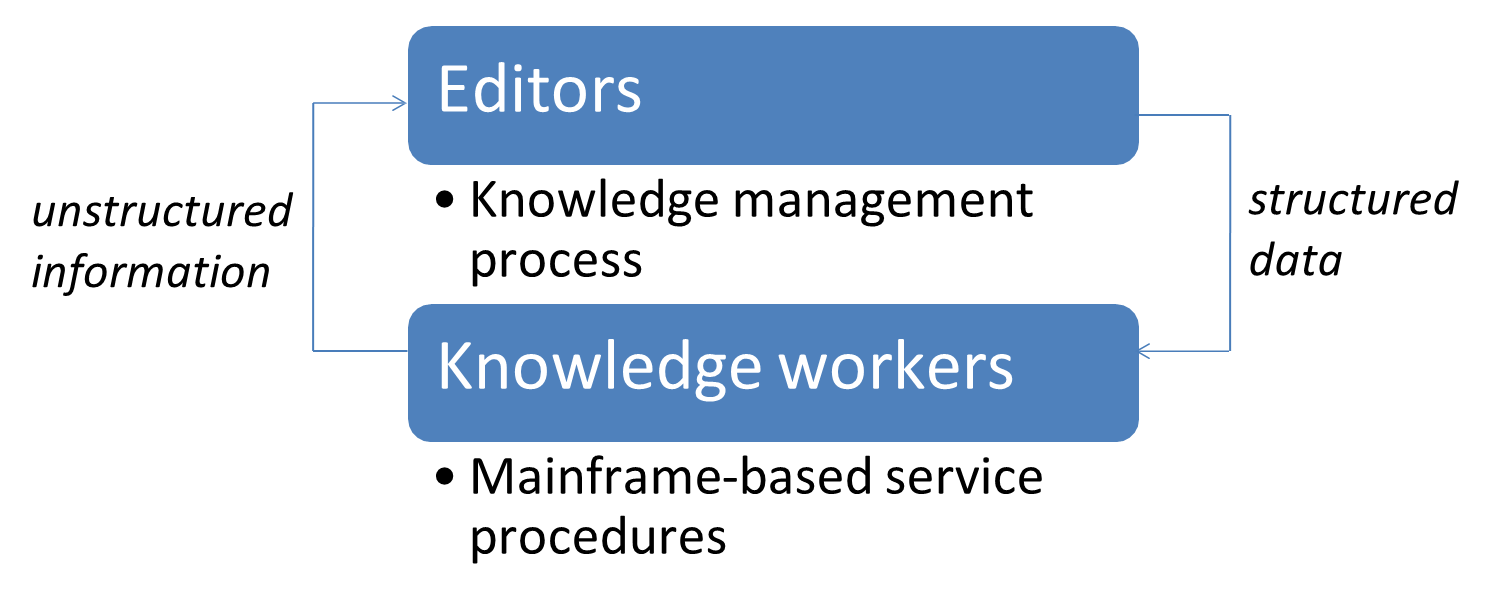

Data Management and Integration: Data entered into the application is stored in the operational database in a structured format. Unlike traditional methods that relied on Word documents or handwritten notes, this approach enables efficient data retrieval, analysis, and reporting. Structured data allows insurance companies to analyze customer profiles, identify trends, and generate predictive insights.

-

Error Reduction and Efficiency: By automating decision pathways and standardizing data input, desktop applications minimize human errors. They ensure that agents adhere to company policies and regulatory requirements, thus reducing compliance risks.

-

Training and Onboarding: The use of intelligent applications also facilitates faster training and onboarding of new agents. Instead of memorizing complex procedures, agents rely on the application’s prompts and recommendations to carry out their tasks effectively.

Knowledge Management and Continuous Improvement

While desktop applications streamline the underwriting process and store structured data, they are also instrumental in knowledge management. Not all information can be effectively captured in structured databases. For example, customer interactions, reasons for policy rejections, or customer dissatisfaction may be recorded in the form of notes or qualitative data. This unstructured data holds valuable insights that can help businesses refine their products and services.

Knowledge management systems can analyze unstructured data using natural language processing algorithms. These systems extract key information, identify recurring issues, and suggest potential areas for improvement. By systematically reviewing customer feedback and analyzing failed policy offers, insurance companies can refine their products to meet evolving customer needs.

Once an insurance company has established a robust knowledge management system, it can proactively identify opportunities for upselling and cross-selling. For example, if a customer has a young child who will soon reach driving age, the system can automatically notify the agent to recommend a relevant policy. This level of personalization enhances customer satisfaction and increases revenue through targeted sales.

In addition, predictive analytics can assess historical data to predict customer behavior, anticipate churn risks, and recommend retention strategies. By leveraging both structured and unstructured data, insurance companies can develop tailored marketing campaigns and optimize their product offerings.